Programming Slate Summary

PlatformsAdvertising offers by platform

ShowsCurrent programming directory

Schedule GridsBroadcast schedules by platform

Creative FormatsAvailable types of advertising

Technical SpecsAdvertising standards and formats

Custom storytelling solutions

Commercial ProductionIn-house production services

MAX CBC/Radio-CanadaDigital ad buying platform

Distribution - Archive SalesAccess to CBC/Radio-Canada's archives

Audience research

Back in the mid 80s, as the main buying demo of 18-49 aged, so did total tuning. At that time, the main buying demo shifted to 25-54. Today, the main buying demo continues to shift along with tuning, and as an industry we need to move with it. Is it time to reconsider our key demo?

There are compelling arguments for targeting the 35-64 group instead of the 25-54 in advertising campaigns:

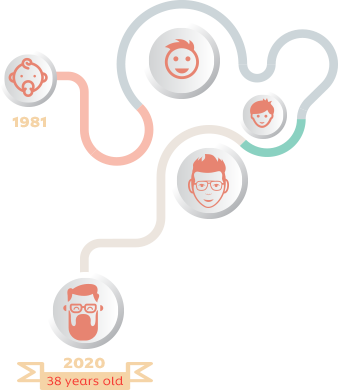

If we define 1981 as the start of the millennial generation, the older ones are now 38 years old and have joined the 35-64 group. Other millennials will soon follow.

Millennials are the largest generation in Canada. In 2018, over 7.3 million millennials lived in Canada, the largest demographic since the Baby Boomers1. And they are more educated than previous generations, putting them in a strong financial position2 for the future.

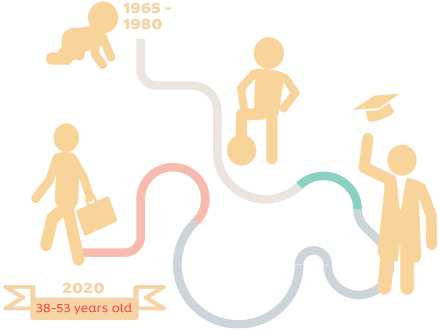

Gen X is wholly contained in the 35-64 group. Its members were born between 1965 and 1980 and are between 38 and 53 years old3. They represent 26% of the Canadian population and are more likely than other generations to have household incomes over $ 100,000 per year4. They consume technology differently, subscribing to traditional TV, tablets and wearables more than millennials, which means the distribution channels to reach them are different.

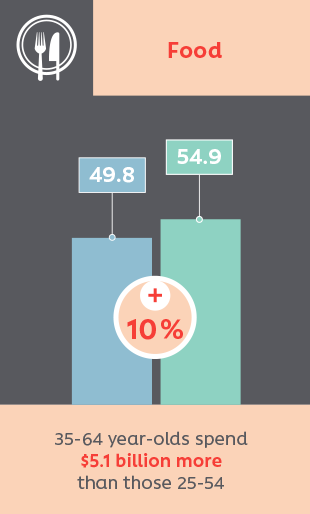

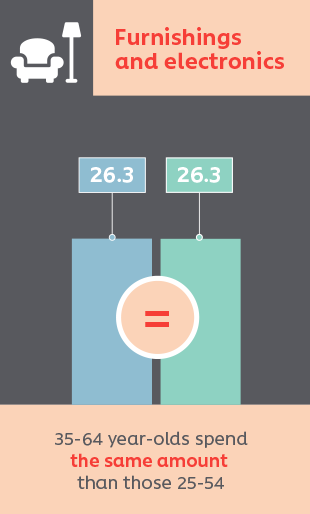

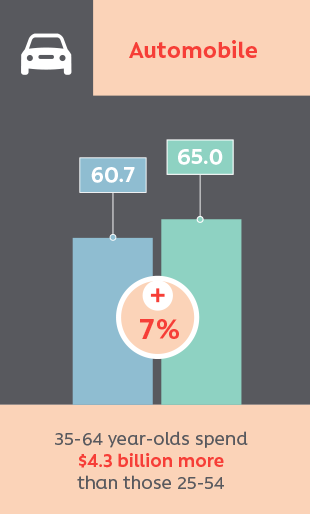

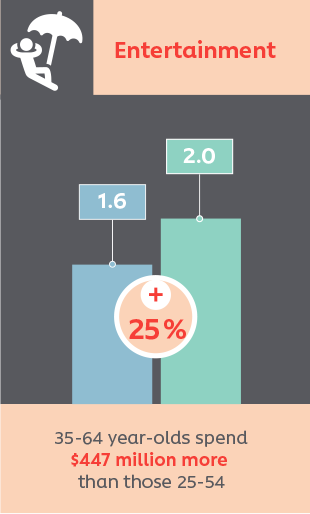

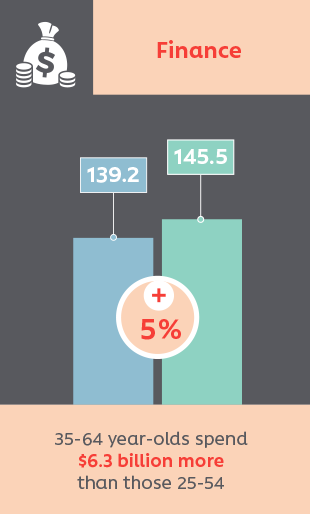

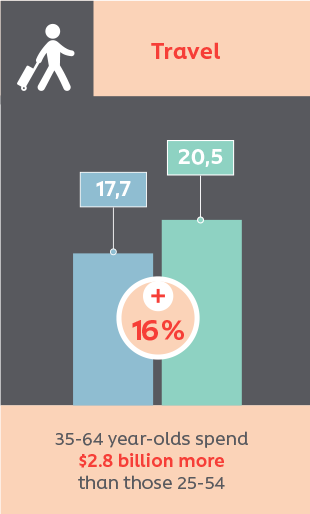

Members of the 35-64 demo have great economic advantages. They spend more than the 25-54 group, accounting for over 65% of total spending in Canada5. 35-64 households spent $ 61 billion more than those in 25-54. They also spend more than the 25-54 group in most categories, as seen here.

Targeting the 35-64 demo instead of the 25-54 can be more advantageous for ad campaigns, since 35-64 group members have high household incomes and spend more in most categories. This trend is expected to continue as millennials enter this group. The industry would see gains of 30% to 35% in English Canada and 35% to 45% in French Canada by changing the main buying demo.

Sources

1 : Media Habits of Millennials in Canada 2018

2 : Economic Well-being Across Generations of Young Canadians: Are Millennials Better or Worse Off?

3 : Are millennials different?

4 : Gen X: Affluent, connected and traditional

5 : Research Directorate, Source: Statistics Canada, Survey of Household Spending in 2017 (August 2017), total household expenditure.

Select an option to advertise in the CBC/Radio-Canada ecosystem

We and select advertising partners use trackers to collect some of your data in order to enhance your experience and to deliver personalized content and advertising. If you are not comfortable with the use of this information, please review your device and browser privacy settings before continuing your visit.